Crypto natives represent a distinct investor archetype that bypassed traditional financial systems entirely, forming their foundational understanding of asset ownership through direct engagement with Bitcoin, Ethereum, and other digital currencies rather than stocks, bonds, or conventional banking products. These younger investors—who’ve witnessed the stablecoin market balloon to nearly $250 billion by mid-2025—champion decentralized finance, embrace volatility with remarkable equanimity, and advocate for “Code is Law” principles that prioritize trustless mechanisms over regulatory oversight. Their influence extends beyond mere investment behavior, catalyzing the transformation of digital assets from niche enthusiast curiosity into structured Web3 infrastructure that challenges conventional financial intermediaries at their very foundation.

How does one define a generation whose first foray into asset ownership bypassed centuries of traditional finance entirely? The Crypto Native represents precisely this phenomenon—individuals whose initial exposure to wealth accumulation occurred through cryptocurrency rather than traditional assets like stocks or bonds.

These digital pioneers emerged following Bitcoin’s 2008 launch by the enigmatic Satoshi Nakamoto, establishing the foundational cohort of what would become a distinctly different investor archetype. Unlike conventional investors who gradually diversified into crypto, Crypto Natives approached financial markets in reverse chronological order.

Their formative experiences involved steering through Bitcoin’s early volatility phases, witnessing industry-defining events like the Mt. Gox exchange collapse and Silk Road’s shutdown—hardly the typical portfolio diversification lessons found in traditional finance textbooks. These early adopters developed an unwavering belief in cryptographic algorithms and blockchain technology as fundamental principles governing digital asset integrity.

The demographic skews younger, naturally, comprising individuals whose earliest career or financial engagement occurred within the cryptocurrency ecosystem. When Ethereum launched in 2014, introducing smart contracts and expanding possibilities beyond Bitcoin, the Crypto Native identity evolved beyond simple digital currency enthusiasts.

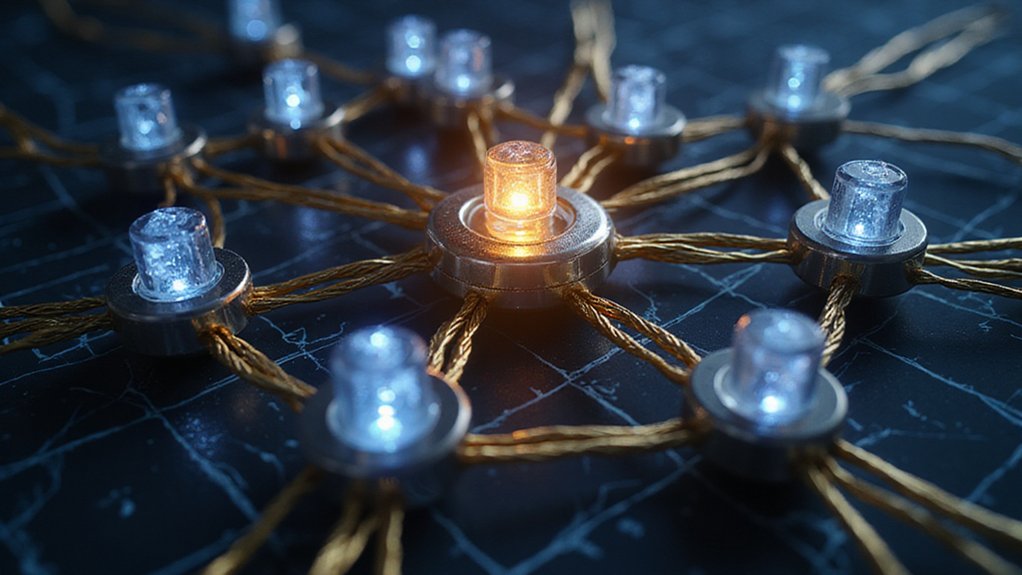

They became advocates for decentralized finance (DeFi) and various blockchain applications, embracing the ethos that “Code is Law”—a philosophy emphasizing trustless mechanisms and decentralization over traditional intermediaries. Their investment behavior reflects this philosophical foundation.

Crypto Natives typically maintain long-term holdings rather than seeking quick profits, accepting the inherent volatility and risks associated with digital assets. This acceptance stems from their belief in blockchain technology’s transformative potential rather than purely financial motivations.

They exhibit marked skepticism toward traditional financial intermediaries and regulatory overreach, preferring open-source protocols that promote user autonomy and censorship resistance. The maturation of cryptocurrency infrastructure—mining hardware, exchanges, payment systems, and financial derivatives—occurred alongside their influence in establishing the crypto ecosystem. Interest in the Crypto Native movement has experienced dramatic growth, with mentions increasing by 2.85 times in the first 11 months of 2022 compared to 2021.

What began as niche enthusiasm among early adopters has evolved into a structured industry, with Crypto Natives serving as both catalysts and beneficiaries of this transformation. Their advocacy for financial sovereignty and transparency continues shaping digital asset adoption patterns. These individuals particularly value the ability to conduct direct peer-to-peer transactions without requiring traditional banking intermediaries or payment processors.

The stablecoin market cap has reached unprecedented levels near $250 billion in mid-2025, demonstrating the maturation of digital assets that many Crypto Natives have embraced as essential components of the Web3 economy.

Frequently Asked Questions

How Do Crypto Natives Typically Earn Income From Cryptocurrency Activities?

Crypto natives generate income through multiple channels: trading and HODLing for price appreciation, participating in DeFi yield farming and liquidity provision, staking tokens for validation rewards, and mining cryptocurrencies.

They also monetize expertise through blockchain employment, content creation, and NFT development.

Many diversify across these activities—because apparently putting all one’s eggs in a single volatile digital basket isn’t quite thrilling enough for this particular cohort.

What Age Groups Are Most Commonly Represented Among Crypto Natives?

Crypto natives skew dramatically young, with Millennials comprising roughly 76% of buyers and Gen Z accounting for another 17%—creating a nearly 94% concentration among the under-40 crowd.

While recent data suggests Gen X participation has climbed to 20% (perhaps finally discovering what their kids were buying), Boomers remain conspicuously absent at barely 1%.

The demographic distribution reveals crypto’s generational divide more starkly than any other investment class.

Do Crypto Natives Prefer Centralized or Decentralized Exchanges for Trading?

Crypto natives exhibit a pragmatic bifurcation in exchange preferences, gravitating toward centralized platforms for their superior liquidity and streamlined user experience while simultaneously appreciating decentralized alternatives for enhanced security and asset control.

This dichotomy reflects their sophisticated understanding of trade-offs: accepting custodial risks for operational efficiency on CEXs, yet migrating to DEXs when prioritizing autonomy over convenience—a calculated hedging strategy across platforms.

How Do Crypto Natives Protect Themselves From Scams and Security Threats?

Crypto natives deploy multilayered security architectures combining hardware wallets, rigorous private key management, and sophisticated threat intelligence gathering.

They maintain constant vigilance against evolving scam vectors—from DeFi flash loan exploits to governance token manipulation schemes.

Their defensive posture includes diversified custody solutions, meticulous smart contract auditing, and active participation in security-focused community networks.

Most importantly, they treat cybersecurity as an ongoing operational discipline rather than a one-time implementation.

What Percentage of Crypto Natives Hold Bitcoin Versus Altcoins?

Specific allocation percentages between Bitcoin and altcoins among crypto natives remain elusive—surveys typically aggregate broader ownership patterns rather than dissecting native portfolios.

However, given their diversification tendencies and risk management sophistication (as discussed regarding security threats), most crypto natives likely maintain mixed holdings.

The average crypto owner holds multiple cryptocurrencies, suggesting natives—with their deeper market understanding—probably allocate strategically across both Bitcoin’s stability and altcoins’ innovation potential.